The History and Evolution of Actuarial Science

From Life Tables to Big Data: The History and Evolution of Actuarial Science The journey of understanding how we manage …

From Life Tables to Big Data: The History and Evolution of Actuarial Science The journey of understanding how we manage …

Have you ever wondered how life insurance companies set their rates or how pension funds know they will have enough …

The Mathematics and Statistics of Actuarial Science When you hear “actuarial science,” your mind might immediately go to highly complex …

The Core Principles of Actuarial Risk Every day, individuals and businesses face uncertainty. From unexpected health issues to property damage, …

The Actuary’s Role in the Insurance Industry When you think about insurance, you might picture friendly agents, quick claim services, …

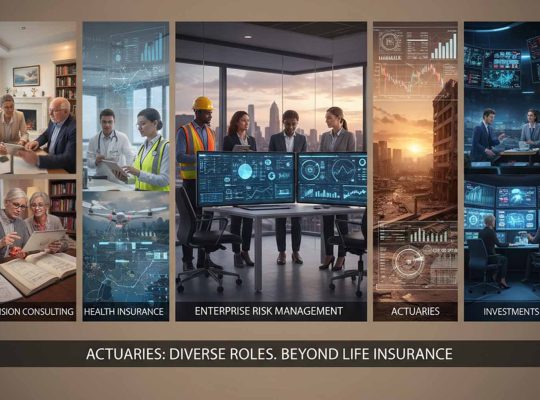

7 Common Myths About Actuarial Science Many people hold ideas about actuarial science and actuaries. However, these perceptions often do …

What is Loss Reserving in Insurance Imagine an insurance company. It acts like a trusted friend. This friend promises financial …

Beyond Insurance: Unexpected Careers in Actuarial Science Many people connect actuarial science directly with insurance, and for good reason. Actuaries …

Investment risk doesn’t live in a vacuum. Every portfolio, asset allocation, or pension fund strategy faces uncertainty driven by market …

Remote work offers actuaries flexibility, but it also opens the door to scattered focus, delayed outputs, and mental fatigue. Client …